Preferred equity in real estate offers investors a unique way to earn returns while balancing risk and reward. It sits between senior debt and common equity in the capital stack, giving investors special privileges.

You get priority in cash flow and profits compared to common equity holders, potentially leading to higher returns.

In this article, we’ll explain:

- what preferred equity in real estate is

- how it works

- the advantages and disadvantages

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter

What is Preferred Equity in Real Estate?

Preferred equity is a type of investment that sits between debt and common equity in real estate deals. It gives investors priority in receiving returns over common equity holders.

You can think of it as a hybrid between a loan and an ownership stake.

Preferred equity investors get paid before common equity owners. They often receive a fixed return rate. This makes it less risky than common equity but potentially more rewarding than debt.

In real estate, preferred equity is common in large commercial projects. It helps fill funding gaps when bank loans and regular equity aren’t enough.

What are the Capital Stack Components?

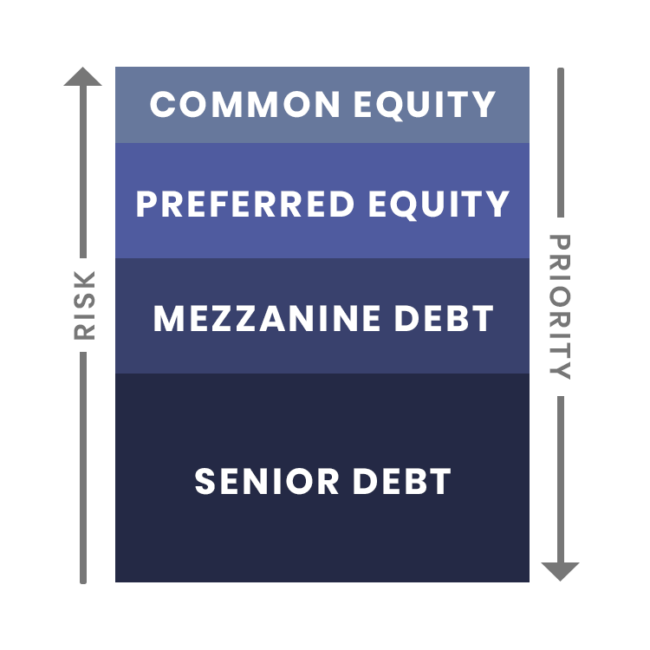

The capital stack shows how a real estate project is funded. It has different layers, each with its own risk and return profile.

At the bottom is senior debt, usually from banks. It’s the safest but offers the lowest returns.

Next comes mezzanine debt, which is riskier but pays more.

Preferred equity sits above mezzanine debt. It offers higher returns than debt but less risk than common equity. At the top is common equity, which has the highest risk and potential reward.

Here’s a simple breakdown:

- Senior Debt

- Mezzanine Debt

- Preferred Equity

- Common Equity

Each layer plays a crucial role in funding real estate projects.

Preferred Equity Investor Advantages

Preferred equity offers several benefits to investors.

#1. Cash flow priority

You get priority in receiving cash flows from the property. This means you’re more likely to get paid even if the project underperforms.

#2. Fixed returns

Your returns are often fixed, providing a steady income. This is similar to interest payments on a loan. But you also might get a share of the project’s profits, known as an “equity kicker.”

#3. Higher yields

Preferred equity can offer higher yields than traditional debt investments. This makes it attractive in low-interest-rate environments.

#4. Less risk

It’s also less risky than common equity, as you have priority in payment.

You might get some control rights too. This can include approval over major decisions or the right to take over if the project struggles.

Join the Passive Investors Circle

Role of Senior Lenders and Mezzanine Financing

Senior lenders, usually banks, provide the main loan for a real estate project. They have the lowest risk and first claim on the property if things go wrong. Their interest rates are typically the lowest in the capital stack.

Mezzanine financing fills the gap between senior debt and equity. It’s riskier than senior debt but safer than equity.

Mezzanine lenders often get higher interest rates to compensate for this risk.

Both senior lenders and mezzanine financiers provide necessary capital while leaving room for preferred equity. This structure allows developers to maximize their funding options.

Senior lenders set the tone for the whole deal. Their terms often influence how much a project can take on mezzanine and preferred equity.

Risk and Return Profile

Preferred equity carries more risk than debt but less than common equity. You take on added risk compared to lenders but get higher returns ranging from 8-12% annually.

The trade-off is less safe than loans as the property doesn’t back your investment. But you get paid before common equity holders if things go south.

Preferred equity can offer steady cash flow as most deals pay quarterly distributions (our Passive Investors Circle members enjoy this). This gives you ongoing income while you wait for the final payoff.

Common Equity vs Preferred Equity

| Aspect |

Common Equity |

Preferred Equity |

| Risk and Return Potential |

Highest risk and return potential. Investors share fully in profits but also take the biggest losses if things go wrong. |

More conservative with set return rates, often 8-12% per year. This caps upside but limits downside risk. |

| Payment Priority |

Paid after preferred equity holders and other creditors, which means higher risk but potential for higher returns. |

Higher payment priority than common equity holders, providing an additional layer of protection to the investment. |

| Characteristics |

Fully participates in the profits and losses of the company, offering the highest potential for growth but also the highest risk. |

Sits in the middle, offering steadier returns than common equity with more upside than debt, and providing a balance between risk and return. |

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter

Strategic Considerations for Investors

Investing in preferred equity real estate requires careful planning and analysis. Investors need to weigh several key factors to make informed decisions and maximize their potential returns.

Aligning with Investment Objectives

Your investment goals shape your preferred equity strategy. Think about your risk tolerance and expected returns.

Preferred equity often offers higher yields than traditional debt but comes with more risk than senior loans.

Look at the property type and location. Multifamily, office, or retail? Each has its own market dynamics. Urban core or suburban areas? This affects potential growth and stability.

Consider the investment timeline. Are you seeking short-term gains or long-term income? Preferred equity terms can range from a few years to a decade or more.

Evaluate the sponsor’s track record and expertise in the specific property type and market. Their skills directly impact your investment’s success.

Due Diligence and Past Performance

Thorough research is crucial before committing to a preferred equity investment. Review the sponsor’s past projects and their outcomes. Look for consistent performance across different market cycles.

Examine the property’s financial statements, occupancy rates, and tenant mix. These factors influence cash flow and potential returns.

Assess the capital stack structure. Understand where your investment sits in relation to other debt and equity positions. This affects your risk level and payout priority.

Get professional help if needed. A financial advisor or real estate expert can provide valuable insights and spot potential red flags.

Diversification and Asset Allocation

Spreading your investments across different preferred equity deals can help manage risk. Don’t put all your eggs in one basket.

Mix property types in your portfolio. Combine stable assets like multifamily with potentially higher-yield opportunities in office or retail.

Balance preferred equity with other real estate investments. Consider REITs, direct property ownership, or debt investments to create a well-rounded portfolio.

Pay attention to geographic diversity. Different regions have varying economic drivers and real estate cycles. This can help protect against localized market downturns.

Set a target allocation for preferred equity within your overall investment strategy. This helps maintain a balanced approach aligned with your financial goals.