How do we improve?

"Losing unconventionally is hard. Living through the tough times and staying disciplined to what you rationally believe in seems to be the secret ingredient in the success of many historically great investors." -Cliff Asness | AQR

Before beginning, let me share the best approach I’ve read on how to select an investment approach. In The Behavioral Investor by Dr. Daniel Crosby, he states that for any style of investing to be considered, “…it must be empirically supported, theoretically sound, and behaviorally intransigent.” I’ll add one extra item, that I like. Can it be explained to a middle-schooler and they understand? We talked at the beginning that your investment approach should take on the same rigorous examination as research within the medical community. The sheer amount of research (more being published daily) is monumental, for the sake of brevity only including a small part of it. I’ve linked to all the various sources and have countless more to share.

If you haven’t found the previous posts controversial, by the end of this one I may have the Boglehead crowd coming at me with pitchforks and torches. That’s okay, because as Terry Pratchett stated best in his novel The Truth, “Be careful. People like hearing what they already know, remember that, they get uncomfortable when you tell them new things.” I want to talk about the three core investment principals I believe in Trend Following, Momentum, and Value.

The Trend is Your Friend

Trend Following: Is a rules-based method that removes emotions from decision making. By investing broadly across asset classes and geography, it provides investors with more opportunities to see returns. There are many versions of trend following, so we will not touch on every detail here. I do believe there is merit to an allocation to trend following using futures and utilizing shorting (making money when the market loses money).

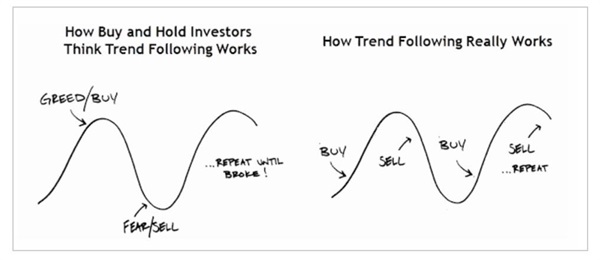

Figure 1

The research supports the approach as a means to lower risk and potentially enhance long-term returns. The starting point I’d suggest to learn about trend following is Meb Faber’s work A Quantitative Approach to Tactical Asset Allocation. In my humble opinion is a MUST read, before you have an opinion on trend following.

His work was the beginning of my interest and reading on trend. If you don’t want to read a 70-page paper (although there are tons of great charts), I'll summarize. The idea of the approach is not to optimize and data mine the perfect solution, but build a method that works in the vast majority of markets. Meb using a longer-term moving average (10 months) of the S&P 500. When the market is above the 10-month moving average, you would own the market, and when it is below, you’d sell and move into 90-day Treasury Bills which are considered “riskless” investment. The findings from 1901 – 2012 (long-term) vs. Buy & Hold offered over 0.50% annualized return with almost a 1/3 less volatility (the up and down market gyrations). The kicker is a max draw-down of -9.54% vs. -46.00%. The return on $100 becomes $5.205M using the trend approach and $2.163M with buying and holding the S&P 500. That’s material enough difference to dig deeper.

Meb continues that more diversification (looking at other types of investments) may improve results. In regards to diversification, the findings hold water in other indexes (investment types) as well. Think Global Stocks, Bonds, Commodities, Real Estate, and Small US Stocks. Trend works! The results go against most everything that we are taught since we were young. “Time in the market is better than timing the market.” How trend wins is by avoiding the losses that shake every investor to our core. Remember the behavioral biases we covered?

“One of the benefits of a quantitative system is that it protects the investor from innate behavioral biases." - Meb Faber | Cambria Investment Management

So should you now put in place a Trend Following system and be done with it? Trend like any strategy will go through periods of under-performance casts doubts when all your friends, neighbors, and message board gurus are making money. Bloomberg recently ran a story on the very topic called One of Wall Street’s Most Popular Trading Strategies Is Now Failing. While I believe explaining under-performance to Donald Trump’s tweets offers no statistical evidence of a broken system, it’s worth sharing the noise in the headlines on the strategy. I revert to Corey Hoffstein from Newfound Research in his quote, “No Pain, No Premia (Returns).”

If you think Isaiah and Meb are two crazy people who think trend works. I could write an entire book on the research I’ve read. Alpha Architect in their paper, Avoiding the Big Drawdown with Trend-Following Investment Strategies states, “Academic research indicates that investors who can stomach short-term volatility, avoid benchmark comparison, and follow a model, can systematically outperform over long periods of time. We find the same conclusion with what are often referred to as “tail-risk” investment strategies, better known as trend-following strategies…However, we believe there is a behavioral story underlying the success of trend-following systems. Consider the concept of dynamic risk aversion, which is the idea that human beings don’t stick to a set risk/reward behavior—their appetite for risk can change depending on their recent experience."

Jeremy Siegel finds inStocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies that trend following had outperformed a buy and hold by over 4% per year from 1972-2006 even when accounting for all costs, and with 25% less volatility. An anonymous blogger called EconomcData wrote in, The Behavioral and Performance Benefits of Trend Following about the difficulties in trend. He shares, “Trend following has historically provided strong long-term returns with materially reduced draw-downs relative to a traditional buy and hold investment, but none of this matters if an investor cannot stick with the strategy through periods of relative underperformance." I used his photo earlier in figure 1 to describe trend following via a drawing.

Finally, another widely read, listened to, and followed advisory team is Ritholtz Wealth Management. I believe they are the #1 fasting growing RIA (registered investment advisor) business in the nation. They are incredibly talented, and I quoted Josh Brown in my first article about “Mutual Fund Salad,” nonetheless they discuss trend following in a recent video here.

Not always rosy

I don’t want to paint a rosy picture for trend following, as there are a lot of critics as well. Even those who use it and advocate for it have caution becoming too intoxicated with the strategy. A recent post by alpha architect well documents the concerns. Trend-Following: A Decade of Underperformance talks about how adjusting the time frame by small amounts can make all the difference in the strategy looking tremendous or downright awful. Murray Coleman authored a recent article called Market Timing: More Evidence Why It Doesn’t Work, while the material focus is not on trend following he advocates why buy and hold should be the only way to go. That’s why if you decide to put in place a trend following process you must relentlessly execute upon it even in the face of under-performance. The moment your greed is too high is the moment you’ll make a change. Once the change is made, you will finally see compensation for the patience in a system that has shown its merit across asset class and long-term periods.

There are likely more questions you have. First, I'd encourage you to read the links above. I know the ones that I’m often asked, how do I do it? What about the trading costs? What about taxes? How much trend do you use for yourself or clients? Why don’t more advisors do this?

I take a blended approach like what Michael Batnick in the video above discusses. I credit this change to my discussion with Corey Hoffstein, who I much admire and appreciate. I blend the five-month, seven and a half month, and ten-month moving averages. I re-balance half the model at the beginning of the month and a half at the end of the month. The re-balance and time frames allow for less all-in or all-out calls. I use the asset classes (investment types) on page 43 of Meb’s paper. The custodian (where the investments are held for myself and clients) I use offers a variety of no-transaction-fee ETFs, the only investment that I pay for is the Gold exposure. Taxes? I only have this part (again I DO NOT believe in being 100% invested in trend following) of the investment strategy in retirement accounts. How much trend following do I advocate for? It all depends on the client’s risk tolerance and capacity per their financial plan. I have 40% of all my investable assets in the trend following model — the last question we will address later in the post.

Value - Buy'em Cheap

When I say value investing, almost everyone would deem that a “smart” investing strategy. Buying cheap things is in our blood. I mean who does not love getting a discount on something? Warren Buffet is the Godfather of value investing, and everyone looks to him as the benchmark for what a value investor should be. One of his very famous quotes is, “Price is what you pay. Value is what you get.”

"Value stocks earn a higher return because investors make behavioral errors and push stocks beyond their intrinsic value." -Josef Lakonishok, Robert W. Vishny, Andrei Shleifer | Contrarian Investment, Extrapolation, and Risk

The challenge of value investing is there are so many variations of what value investing looks like, how do you choose? Is it a low Price to Earnings Ratio (P/E), Price to Book (P/B), Price to Enterprise Value, or Earnings Before Interest Depreciation Taxes / Enterprise Value (EBIT/EV)? A quick Google search will show you 186 of the Best Large Value Mutual Funds or The Five Best Value Funds today. Recently, in their weekly research piece, Dan Rasmussen from Verdad wrote an article about “Why do most active managers fail?” He writes, “Value investing is one of the simplest and best-investing ideas, pioneered by Benjamin Graham, confirmed empirically by Fama and French, and replicated dozens of times in study after study. But after performing a comprehensive analysis of the portfolios of active mutual funds, ETFs, and hedge funds, Martin Lettau of UC Berkeley found that there were virtually no funds that actually exclusively held the cheapest stocks. In fact, most “value” funds hold a higher proportion of their portfolios in expensive growth stocks than cheap value stocks.” So you can bet that those 186 best large “value” mutual funds are likely only value in the name.

"The value factor generates excess returns by efficiently capturing the eventual tightening [return to fair price] of a stock’s discount." -O'Shaughnessy Asset Management| Factors from Scratch: A look back, and forward, at how, when, and why factors work

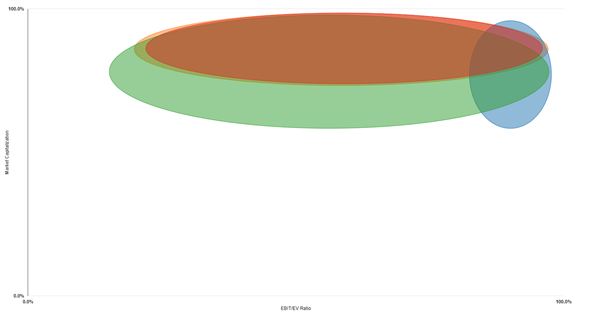

A picture is worth a thousand words. Below are two of the most significant value ETFs and a lesser known smaller ETF. The smaller ETF is built based on the academic investment style of value. Saying academic value is the excellent way of saying the stocks you’d not want to not mention at cocktail hour to impress your peers. These are the “cash for clunker” type of names.

Figure 2

So what does figure 2 tell us? We are looking at EBIT/EV on the X-axis and Market Capitalization (Size) on the Y-axis. EBIT/EV is per the DIY Financial Advisor: A Simple Solution to Build and Protect Your Wealth by David Foulke, Wes Gray, Jack Vogel, “…a simple and effective way to capture the value premium." The large well known ETFs cannot be truly value oriented. Why? They are too large with too much money invested. You want to be in the far right section of the graph, not wide-spread. The red section is the S&P 500, the green and orange (hidden) are almost the same amounts of “value” as the broad market. Why does this happen? The investment industry doesn’t want to get out of bed for a fund that can “only” raise 1 billion dollars. So what do they do? Change the “value” philosophy to move from being academically proven, to a very technical term called “good enough.” When I advocate for value, it’s critical you own value in the academic sense. Even when it's uncomfortable or ugly.

We discussed how to identify value when looking globally using CAPE and Price-to-Book in tandem in a previous post so I will not rehash that conversation. If you need a refresher refer to part III.

"Simply put, we believe value wins on average over the long term but not all the time, even for a near decade. Poor periods in the past have never meant that the factor shouldn’t work going forward. The logic, historical track record, etc., all are intact, and no story for now being different seems to hold water (no weird value spreads, no super-high transactions costs, it’s not all driven by outdated value measures)." -Cliff Asness | AQR | Liquid Alt Ragnarök?

Buy'em Strong

Momentum buys and sells companies based on recent movement. The fundamental analysis and market purist often call the strategy as heresy. The easiest way to think about momentum is a force that is in motion tends to stay in motion. Hence our pendulum above. Stocks that are performing well will continue to perform well, those that losing well you know what happens. The concept makes sense when we step back and look at the names that drive the market higher. Rarely do all the companies in the index do well at the same time. In mid-2018 five companies drove about 90% of the index performance. Those five are all household names, Amazon, Microsoft, Apple, Netflix, and Facebook. This is typical not a rarity. In 2017, the same thing except take out Microsoft and insert Google. These are not outlier years, it’s happened this way for years. You can make the claim that the Market-Cap-Weighting is somewhat a form of momentum. You buy more of what is going up.

"Momentum generates its excess returns in an opposite manner from Value, a fact that helps explain why the two strategies complement each other well in diversified portfolios."-O'Shaughnessy Asset Management| Factors from Scratch: A look back, and forward, at how, when, and why factors work

One of the first academically based research studies on momentum performed way back in 1937 by Herbert Jones and Alfred Cowles III. More recently in 1993 by Narasimhan Jegadeesh and Sheridan Titman called Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. They found that the momentum factor was not only was a profitable one but statistically significant across time. Andrew Berkin, and Larry Swedroe explain in Your Complete Guide to Factor-Based Investing, the evidence supporting the momentum factor (both cross-sectional and time-series, or absolute momentum) that the premium (return) is persistent across time, pervasive around the globe and across asset classes, robust to various definitions, and implementable. In what is called the world’s longest backtest Chris Geczy and Mikhail Samnov in 2016 found that momentum investing has worked in the US since 1801, in over 40 countries, and in more than 12 various asset classes (stocks, bonds, gold, real estate etc.).

Simple right? Not exactly.

“...the human brain is wired to act against the momentum factor. The propensity to act against a strongly trending asset leaves money on the table for others to pick up. Other human tendencies, such as social herding and anchoring biases also contribute to the momentum effect. For example, strategies that harness the momentum factor often act very differently than traditional portfolios. During periods when traditional portfolios are doing really well, being different often means lagging behind. And this underperformance can sometimes last for a couple of years or more. For this reason, many investors find it hard to stick with a momentum strategy for long enough for it to pay off for them." ReSolve Asset Management | Adaptive Asset Allocation: A Primer White Paper

Momentum, when implemented properly, is a much more concentrated strategy that has a much shorter premium maturity (holding period). Often only months, not years so it must be nimble to provide the academic results.

"Sorting stocks based on value and momentum factors historically has led to out-performance over the broad US stock market. " -Meb Faber | Learning to Play Offense and Defense: Combining Value and Momentum from the Bottom Up, and the Top Down

Yeah, but....Costs and Taxes

Isaiah, this all sounds good, but I can own the stock market for free. So what does all this cost? I’m so glad you asked. My current blended portfolio has a cost of 0.482% vs. the 0.06% of Boglehead Three-Fund. I’m able to take 15 different diversified bets, own a portfolio that is empirically, theoretically, and behaviorally sound. The allocation is positioned for success in more market environments (not just one). The allocation should provide for more consistent return over time. That premium I pay is worth it. All I care about is net returns after all fees and taxes. As Wes Gray from alpha architect would say, “All I care about is compounding my face off!”

A sound process will allow you to work towards the returns needed to accomplish your financial plan. Diversification offers more consistency in performance. The power of compounding works best when you don’t have significant material losses. Equal percentage gains and percentage losses are not, in fact, identical. When you lose 30%, you need a 43% to get back to even, a 40% loss a 67% return.

I’m sure you were wondering when taxes would come into play. If you are investing in a taxable account, you’d want to own a momentum/trend/value in an ETF vehicle and not a mutual fund. Why?

"ETFs provide an advantage of 0.9% over mutual funds in terms of the average annual capital gains [payment to investors in the fund] tax burden. When dividends are added to capital gains, the ETF advantage drops to 0.8%." - Rob Arnott, Vitali Kalesnik, and Trevor Schuesler | Is Your Alpha Big Enough to Cover Its Taxes? A Quarter-Century Retrospective "

Also, the structure of ETFs allow for an exchange to happen internally without triggering a sale and thus passing along a capital gain. The best explanation I’ve heard done was by ETF guru Eric Balchunas on the Invest Like the Best Podcast. While I’d be writing a whole other post on taxes, this is critical to consider in all the strategies mentioned.

Facts > Feelings

"We think the evidence that factors like value, momentum, quality/low risk, carry, and trend work over the long-term is incredibly strong. The academic literature, to which we’ve significantly contributed, showing that these things have efficacy, goes way beyond choosing US stocks where many of them were first discovered. That these same factors show success in non-US stocks, equity index selection, sovereign bond market selection, commodities, currencies, credit, where to be on a yield curve, etc., is simply a gigantic set of evidence. Moreover, while obviously (given this note) tough periods occur, these results have held up out-of-sample since they were discovered.” – Clif Asness | Liquid Alt Ragnarök?

Best Results or Client Retention?

So why don’t more advisor use this type of strategies and talk about it? Remember the quote at the beginning from Cliff Asness? Losing unconventionally is hard. Trend, Value, and Momentum all have rough patches. The investment industry will ask, “Is the strategy or approach dead?” As each goes through one of those rough spells, today the case can be made for value and trend. Recall the Bloomberg article shared earlier. A couple of recent articles done by alpha architect Factor Investing Fact Check: Are Value and Momentum Dead? and Corey Hoffstein Factor Fimbulwinter address these types of questions of when or if one should abandon ship.

“Value and Momentum work, independently and in concert, precisely because they exhibit the three hallmarks of an investable factor: empirically supported, theoretical soundness, and a behavioral foundation.” – Dr. Daniel Crosby | The Behavioral Investor

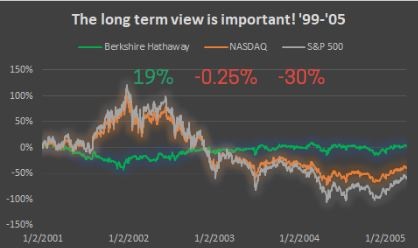

The biggest reason why is it exposes an advisor to career risk and what is called tracking error. Tracking error is best explained as looking different than most other people. Remember Warren Buffett? Look at his tracking error and why it is important to remember being different can be painful.

As an advisor, it’s much easier to sit across a desk and tell a client that their 60% stock, 40% bond allocation that is concentrated in the US lost money. That’s what most people own, so it is familiar. There is no career risk for this advisor because they are not looking to be different. Different means that the client leaves, different means putting in the work to educate yourself. Different means not blindly putting clients into the firm’s vanilla model portfolios and taking their personal fiduciary responsibility seriously. When the markets turn advisors tout the tried and true line, “Be a long-term investor. The markets will recover. Time in the market not timing the market.” All things that are important, and not false, but do little to comfort a client who has seen a large loss. Yes, the market historically goes up over time, but the emotional side of investing haunts investors time after time. The stats and figures back this up. Everyone is a long-term investor when the market moves up, yet lack the self-control when things turn ugly. By owning a fragile and sub-optimal investment approach, you will be faced with more "gut-checks" to stay invested.

"We believe that the optimal investment plan is first and foremost, one that investors can stick with." -Corey Hoffstein | Newfound Research

Education Allows for Long Term Investors

Trend Following, Momentum and Value all need an educated and confident investor; one that understands what a long-term investor is all about. Not an investor who jumps ship and evaluates a strategy based on one, three, or even five-year returns. An investor’s work should be done on the front end understanding and detailing why each approach is used, and how each strategy works independently and together, knowing that when (not if) it suffers not to panic. An investor must be educated, or they will never stay the course to reap the rewards. True diversification means you are always saying sorry for one part of the portfolio. You need diversification that provides comfort in times of stress. Such as trending markets, sudden drawdowns, non-trending markets, rapid inflation, and rising interest rates to name a few. As Dr. Daniel Crosby says in The Behavioral Investor, “You can be right and still be a moron.” So, if you are sitting there are a three-fund-portfolio holder, you’ve done great over the last ten years. Broad-based US investments have been the winning ticket. You’ve been right, congratulations! Are you set-up for success in the next ten, twenty, and beyond? I’ll leave you with a Nassim Taleb quote that sums up my opinions succinctly: “Not seeing a tsunami or an economic event coming is excusable; building something fragile to them is not.”

Summary

- Trend, Value, and Momentum are academically and statistically proven methods to invest

- They all pass the Dr. Daniel Crosby investment rule-book: empirically supported, theoretically sound, and behaviorally intransigent

- Diversification means you always say you are sorry

- Consistency and sustainability build wealth