The Human Element

“When we tell our investors to invest for the long run, we have to make sure the short run doesn’t kill them first… Investing for the long run isn’t bad advice, it’s just unrealistic. It doesn’t take into account human behavior.”

-Andrew Lo | Professor of Finance at the MIT Sloan School of Management

As Andrew points out, we often know what the right advice is. We know we should work out for 30 minutes a day four times per week. We know we should eat two servings of vegetables and two servings of fruit per day. Yet as we also know that sometimes we’re traveling on the road, and Chick-fil-A is right across the street. There are no fresh vegetables in sight. We love top-notch service and a quick bite, so we indulge. Eating a perfectly prepared healthy meal is a goal to aspire to, but it’s not realistic to expect it every meal.

In part 1 we walked through why the case for the simplest of all models (the three-fund portfolio) is compelling. In part 2, we’re going to take a step back even further and look at why investing for the long term is so hard, to begin with by examining some of the research.

What the Research Says: Investing for the Long Term is Hard

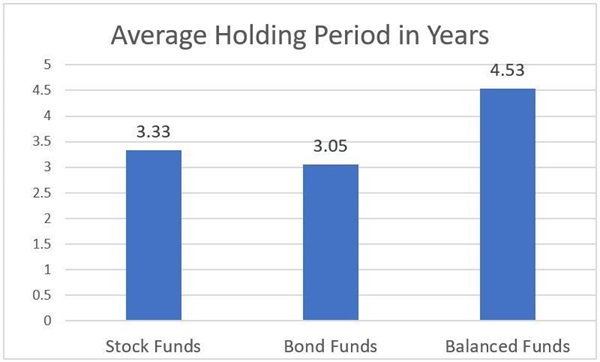

Per research done by Dalbar in 2015 and shown below in figure 1, the average holding period for an investor is between three-four years. Figure 1:

Figure 1

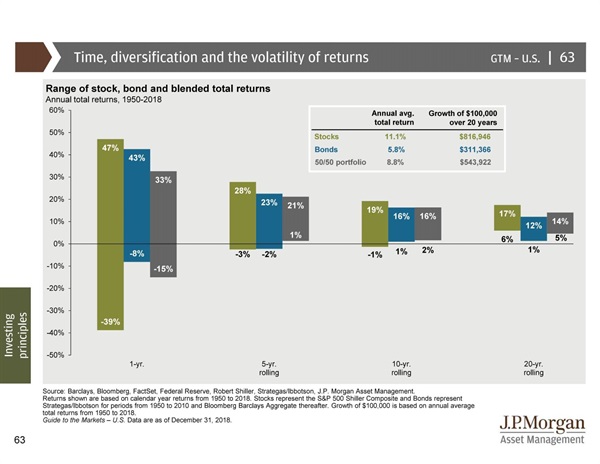

That’s also why in Figure 2, why it’s hard to see market returns with the “short-termism” in investing. The amount of risk in one-year returns in stocks and bonds is considerable. But, if we take a longer-term look into the future, the results become much more palatable.

Figure 2

Three to four years is hardly even thought of as a short holding period. So why is it so hard to invest for the long term? First, losing money hurts twice as much as the gains (Kahneman, D. & Tversky A. (1992)). Second, the human brain seeks to find pleasure and avoid pain.

“Just as we are more likely to repeat an experience when the ending is satisfying, we are also more likely to avoid an experience when the ending is painful.”

-James Clear | Atomic Habits

Third, most investors lack any formalized written investment policy. Meb Faber of Cambia Investment Management believes this number to be 75% of the investor population. The 2018 Modern Wealth Index from Charles Schwab notes that only 22% of Baby Boomers have a written financial plan. The news does not improve much Millennials who come in at 31%.

The Pain Threshold

The Physician on Fire article we referenced advocates visiting Vanguard’s risk tool. The tool helps to find an allocation suggestion that may align with your needs. In working with client’s, I use a different tool call Riskalyze, and a video of the tool is below. My risk number per Riskalyze and risk tolerance per Vanguard’s tool were different. I was much more aggressive per Vanguard assessment than Riskalyze. I had 20% more stocks in the Vanguard results. Take that in any way you’d like I felt it should be noted as we proceed.

Riskalyze Overview

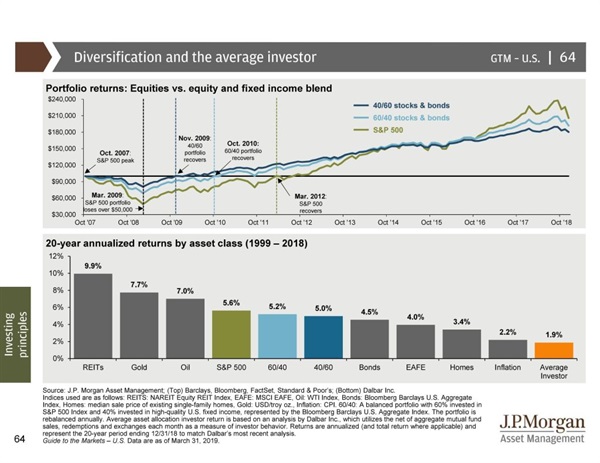

Quantifying risk has always been difficult. People typically have wild swings in what they want depending on their recent experiences. The issue this creates is when times are strong, and returns are favorable people want more risk. The opposite is true as well, when the performance is challenging, and losses are inescapable, people want low risk. Are you ready? Do you understand what you own and why? The challenge is when the pain comes do people systematically buy? According to JPM Morgan and their Guide to the Markets that may not be the case see Figure 3.

When we review the Boglehead three fund portfolio, the last three years included a year without any negative month returns in the S&P 500 (2017). As an investor, the maximum pain threshold would have been seeing a drawdown from the high-water mark of -12.7%. What about a longer-term view, since our focus is on being a long-term investor? If we take a 15-year time frame, to the last substantial loss during the Global Financial Crisis. The -32.58% return from top to bottom would take almost a year and a half, and you would see a hypothetical $1,000,000 investment reset to $674,200. The media, your friends, and your neighbor are telling you the world is going to end and you might want to take your savings (what’s left) and get out. Are you comfortable riding through that? To get back to your $1,000,000 took you a year and eight months. As Mike Tyson always says, “Everyone has a plan until they get punched in the mouth.” In a calm state of mind, it’s easy to explain what we would do. But when markets are crashing (and we know they will), and the cortisol in our monkey brains is surging we tend to act irrationally.

And this also changes throughout your life as your assets grow. It’s one thing to say you know you can suffer a 40% drawdown when you have $100k invested (portfolio loses $40k by going down to $60k). What about when we have a million and are ten years from retiring? Now you’ve just lost $400k, and your portfolio is down to $600k! It is likely that monkey brain is screaming a lot louder in the second example than the first example. The dynamic nature of investing for individuals in the real world is not well captured by academic studies.

If you are approaching even a three-fund portfolio without a written plan, you may succumb to the pressure. Your mind will want to pull the ripcord to stop the pain and make a change at the worst time.

“You’re a bigger wuss than you think you are.”

-Cliff Asness| AQR Funds | When talking about risk

Why knowing your bias is not a solution, it’s just another bias

If, you believe you are an above-average investor though you wouldn’t make a rash emotional decision would you? You have much more will-power. You’ve studied all the research I wrote above and 100 times more! You will not succumb to these biases because you know them. But what if that’s just another bias?

Dr. Daniel Kahneman in Thinking Fast and Slow, states that the most significant behavioral bias we as humans have, is “overconfidence.” 82% of drivers say they are in the top 30% of drivers, and 80% of students think they will finish in the top half of their class (Tilson 2005). In his book, The Little Book of Behavioral Investing James Montier reports that 95% of people think they have an above average sense of humor. Dr. Daniel Crosby in his book The Behavioral Investor has research showing 117 different biases and heuristics that could lead an aspiring investor from making an optimal decision. The four high-level behavioral risks materialize as Ego, Conservatism, Attention, and Emotion. Investing is no different; we all think we can and will be different than the masses and unfortunately, that’s not true, this includes me as well.

The American Association of Individual Investors (AAII) since 1987, has asked all its AAII members to answer the same simple question each week. “Do you feel the direction of the market over the next six months will be up (bullish), no change (neutral) or down (bearish)?” The results show how bad investors are at when they move more money into stocks. The highest percentage of money in stocks was in 2000, right before the Tech Crash. The technology sector was over 30% of the S&P 500 before the crash!

Conclusion: A Plan Matters

If you are coming away from the above still feeling confident that you can stick to a strategy and have a solid written plan. I applaud you. If you are a staunch supporter and investor in the three-fund fund strategy, you are likely more rooted in your position. As know, you can see how weak we as investors are at “timing” the market or choosing investments. The late, great John “Jack” Bogle’s quote is ringing even more accurate.

“Owning the stock market over the long term is a winner’s game but attempting to beat the market is a loser’s game.”

-John “Jack” Bogle | Vanguard Founder

Next, let’s examine the three-fund portfolio. While inexpensive is it optimal for a long-term investor? The last ten years have popularized the method as it has worked. It’s easy to say “The proof is in the pudding” as the three-fund portfolio has performed. Remember we are long term investors, though right? Ten years is not even half of a retirement or a third of the average working life. In the next post, we will deconstruct the portfolio, review how efficient the market is, and explore the academic research.

Summary

- The average holding period of an investor is 3-4 years.

- The average investor’s return over the past 20 years is less than 3%.

- Massive losses happen, are you mentally prepared?

- We all have behavioral biases that affect our investing success