*This post was originally created on Linkedin. Feel free to add me as a connection.

Joao Fabricio Wohnrath. Thank you.

“Health care is opaque with respect to pricing and how much players are compensated along the supply chain, so entrance by an e-commerce giant like Amazon could be a game changer," S&P Global analysts wrote in a recent report titled "U.S. Healthcare is 'prime' for change by Amazon and others."

Amazon made big news after announcing it would seek ways to address soaring health care costs. But the online shopping titan is already focusing its industry-disrupting power on the broader healthcare sector.

The retailer has rolled out a line of private label over-the-counter medicines and is building a business selling a wide array of medical supplies to doctors, lab owners and hospitals. The division responsible for this expansion was named Amazon Business.

It's been two years that Amazon participates having a booth at the Dental Meeting of Greater New York (GNYDM). This is the talk of the market now. Doctor Howard Farran also always mention that topic in his excellent podcast called Dentistry Uncensored. If you are from Dental Industry I highly recommend you to subscribe to it.

I’ve been following Amazon for one year now, since their first appearance at GNYDM. In this meantime, I read their book (The Everything Store: Jeff Bezos and the Age of Amazon – Brad Stone), became a prime member and watched closely the share prices of the main dental companies. Something that is not frequently mentioned and surprising to me from this book is that the book selling for Amazon was a mean to achieve its first and main objective, became the everything store. But the main change that happened in Amazon's business model happened around the year 2000 when eBay appeared to be the future of business on the internet. They had to change their business of an online store to a marketplace.

Today this is totally consolidated. Amazon is a marketplace and not a store. That is the main difference that is going to disrupt the dental and healthcare market. Yes, Amazon is the biggest player in its own marketplace and uses all the data of the transactions to improve and offer better products.

AMAZON AND HEALTHCARE

CNBC reported that Amazon hired a general manager to lead its push into the healthcare market, after holding at least one annual meeting to discuss its plans in this area. A new report from CNBC said Amazon is finalizing its pharmaceutical plan. Amazon recently expanded its Prime Now service in Japan to include drug and cosmetic sales and has also formed a Professional Health Care Program to regulate the sale of medical supplies and equipment in the U.S.

The latest category alarmed by Amazon is the pharmacy market. With huge amounts of consumer spending and frustrating inefficiencies, it is the type of business that invariably attracts Amazon’s attention.

Amazon has received wholesale pharmacy licenses in at least a dozen states. But the licenses permit the company to sell other kinds of products too. In Connecticut, for example, the license is for “wholesale of drugs, cosmetics and medical devices,” while in Louisiana it was granted to a “drug or device distributor.”

The idea could prove attractive to customers who already go to Amazon for a wide range of shopping items, from shoes to electronics to diapers. Retailers like Target and Walmart have added pharmacies to bring in extra business for a similar reason. Amazon’s recent acquisition of Whole Foods could also provide a physical location for pharmacies.

The e-commerce titan has been beefing up its health-tech team as it aims to boost its cloud offerings for healthcare providers, insurers and even the pharmacy market. Amazon has been working to bolster its HIPAA-compliant offerings to appeal to new users and current customers, including Bristol-Myers Squibb, Siemens and Orion Health. The company recently hired Missy Krasner, vice president and managing director of Box's Healthcare and Life Sciences Group, to play a major role on its health-tech team.

AMAZON’S BUSINESS MODEL

“The health care system is absolutely ripe for disruption, nobody’s figured out how to do it yet.”

The book “the everything store” was fundamental for me to understand, the amazon’s business model. Since its creation, Jeff Bezos imagined his company as an Everything store and NOT as a bookstore.

Back to the point, about the business model, Amazon has by far had the most success when it places itself in a position to profit from as many business transactions as efficiently as possible. For me, that is the essence of Amazon's disruptive influence in the U.S healthcare market.

By building a private, for-profit healthcare marketplace on its established marketplace model and infrastructure (including AWS), Amazon can stay at arm’s length from some of the most-regulated and costly aspects of US healthcare while profiting from an immensely scalable business.

Working with extremely low margins and in a remarkably aggressive way, Amazon has "as a brand" the radical change it causes in the markets in which it participates. Its business model is based on exponential growth through a low operating cost and competitive pricing.

THE DENTAL MARKET

Like all their strategies, Amazon started the dental and healthcare business strategies in the US, so we are going to talk about the American local market.

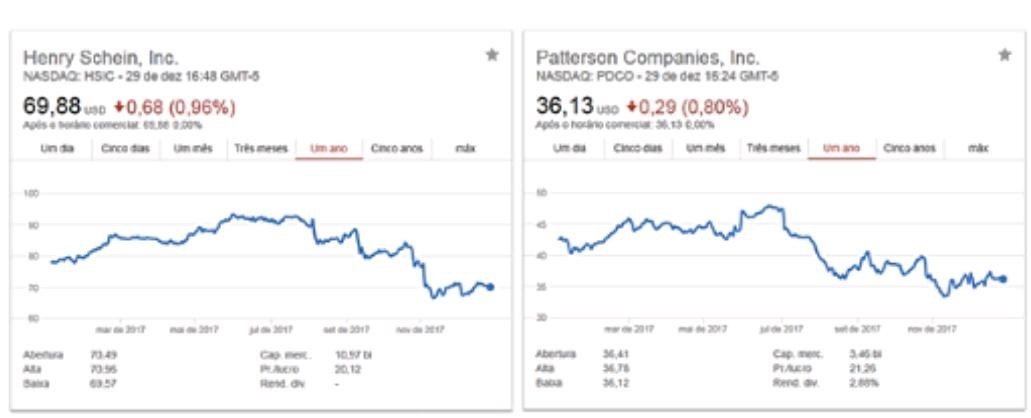

The main distributors of the Dental market, Henry Schein and Patterson Companies have been suffering the consequences. We can notice in their share prices:

The two companies live different times, but both would be impacted by the entry of a gigantic player like Amazon. Henry Schein has a consolidated global presence in addition to a strong presence and a certain degree of leadership in other markets such as veterinarian and physicians. Patterson, for its part, is more focused on dentistry and regionally focused on America. Another reason for Patterson Dental's difficult times was the loss of exclusivity in the sale of Dentsply Sirona CAD/CAM products and equipment. There are rumours that Amazon could get Patterson to use it as a gateway into dentistry, but I particularly do not believe it, because the acting nature of the two companies is not compatible. While Amazon seeks to optimize pricing and structure as a competitive advantage, Patterson has always tried to sell value to its customer.Amazon indicates a majority of the dental products on its business-to-business portal are sourced directly from manufacturers, with the other 50 percent sourced by third parties, wrote the analyst in November, allowing a distributor of Dentsply Sirona products to resell via Amazon.

The way to do business in the Dental market is very different than what Amazon is used to do. Henry Schein, for example, has more than 4500 field consultants and has a close relationship with dentists and laboratories. Amazon will have to find ways to overcome the relationship necessity in order to dominate the market. Meanwhile, at least in the next three years, they will certainly thrive in sales of transactional purchases.

Theory of transactional x relational

- Amazon is going to thrive in the Transactional type of purchases, for products that Dentists and Labs use routinely and doesn’t require a bunch of technical information.

- For the relational purchase and technical products, it will still take some time for them to be the main distributor, for example, Technical products like CAD/CAM and Imaging Equipment, new techniques and new technologies.

Doing my research for this article, I found some very interesting numbers and trends regarding the online buyer behaviour in America. I will leave that below for you to think over these numbers. After all, doesn't matter if you are a dentist, a Lab owner, or work in the healthcare industry we are all BUYERS, and lately, more and more ONLINE BUYERS.

-----------------------------------------------------------------------------------------------------------------------------------

Marketplace shopper characteristics and trends

55% of all e-commerce sales are done through branded stores, vs. 45% via marketplaces.

Of the 45% of all sales through marketplaces, the most common destinations are:

- Amazon – 36%

- eBay – 8%

- Others – 1%

Online shopping

51% of Americans prefer to shop online.

96% of Americans with internet access have made an online purchase in their life, 80% in the past month alone.

E-commerce is growing 23% year-over-year, yet 46% of American small businesses do not have a website.

Online orders increase 8.9% in Q3 2016, but average order value (AOV) increased only 0.2% — indicating that transactional growth is outpacing total revenue.

E-commerce trends by generation

67% of Millennials and 56% of Gen Xers prefer to shop on online rather than in-store.

41% of Baby Boomers and 28% of Seniors will click to purchase.

Millennials and Gen Xers spend nearly 50% as much time shopping online each week (six hours) than their older counterparts (four hours).

48% of millennials have shopped on marketplaces, 76% at large retailer sites, 46% on web stores or independent boutiques, and 29% at category-specific online stores.

56% of Gen Xers have shopped on marketplaces, 76% at large retailer sites, 49% on web stores or independent boutiques, and 37% at category-specific online stores.

59% of Baby Boomers have shopped on marketplaces, 74% at large retailer sites, 42% on web stores or independent boutiques, and 39% at category-specific online stores.

51% of Seniors have shopped on marketplaces, 66% at large retailer sites, 30% on web stores or independent boutiques, and 44% at category-specific online stores.

Millennials and Gen Xers spend 6 hours per week shopping online

Baby Boomers spend 4 per week shopping online.

Seniors spend 2.5 hours per week shopping online.

Buying frequency

95% of Americans shop online at least yearly.

80% of Americans shop online at least monthly.

30% of Americans shop online at least weekly.

5% of Americans shop online daily.

LINKS/SUPPORT:

http://www.oliverwyman.com/our-expertise/insights/2017/nov/health-innovation-journal/tailoring-to-the-individual-s-needs/the-amazon-ing-of-healthcare.html

https://www.google.co.in/url?sa=t&source=web&rct=j&url=https://www.bbc.com/news/amp/business-42877287&ved=2ahUKEwih29L1lufZAhWEJJQKHQc3ANkQFjAAegQIBxAB&usg=AOvVaw39Sp6-Dbg8AFjIiH4xaslA&cf=1

https://www.google.co.in/url?sa=t&source=web&rct=j&url=https://www.nytimes.com/2017/10/27/technology/amazon-pharmacy-drugs.html&ved=2ahUKEwih29L1lufZAhWEJJQKHQc3ANkQFjAEegQIBRAB&usg=AOvVaw2WhAyYLjVHjDdmAlTQmcOP

https://www.google.co.in/url?sa=t&source=web&rct=j&url=https://www.investors.com/market-trend/stock-market-today/futures-slide-as-amazon-berkshire-jpmorgan-deal-rattles-healthcare/&ved=2ahUKEwih29L1lufZAhWEJJQKHQc3ANkQFjAFegQIARAB&usg=AOvVaw2dt_c74O4lXUP-eCfOjMKh

https://www.google.co.in/url?sa=t&source=web&rct=j&url=http://time.com/5128377/amazon-and-friends-takes-on-a-new-industry-health-care/&ved=2ahUKEwih29L1lufZAhWEJJQKHQc3ANkQFjAIegQIABAB&usg=AOvVaw3aD1RPqhk0e9CS6tNNothl

https://www.google.co.in/url?sa=t&source=web&rct=j&url=https://www.barrons.com/amp/articles/amazon-entering-the-healthcare-market-1506004067&ved=2ahUKEwih29L1lufZAhWEJJQKHQc3ANkQFjAJegQIAhAB&usg=AOvVaw2ZqHEvzrfgN1rmVg3bwOLn&cf=1

https://www.google.co.in/url?sa=t&source=web&rct=j&url=https://www.thestreet.com/story/14413067/1/amazon-crushing-schein-and-patterson-on-new-dental-business.html&ved=2ahUKEwiUs6a2l-fZAhVCnJQKHTTTDSYQFjACegQIBhAB&usg=AOvVaw0XYFowiaS-aGlfcJYl8xgA

https://www.google.co.in/url?sa=t&source=web&rct=j&url=https://m.benzinga.com/article/10063836&ved=2ahUKEwiUs6a2l-fZAhVCnJQKHTTTDSYQFjADegQIBRAB&usg=AOvVaw36F1wm0QvUtRZTEtkV_gdY

https://www.google.co.in/url?sa=t&source=web&rct=j&url=https://hbr.org/2018/02/what-could-amazons-approach-to-health-care-look-like&ved=2ahUKEwjfw86N9ebZAhXFFpQKHd1BBCMQFjAEegQIBRAB&usg=AOvVaw0Tfs0Msz9yh6WZOnEOcv5w

https://www.google.co.in/url?sa=t&source=web&rct=j&url=http://www.businessinsider.com/digital-health-briefing-amazon-job-posting-raises-more-healthcare-speculation-change-healthcare-acquires-ndsc-venture-funds-interest-in-ai-grows-2018-1&ved=2ahUKEwjfw86N9ebZAhXFFpQKHd1BBCMQFjAIegQIABAB&usg=AOvVaw352RELAbyodErZmaWYPlsA

https://www.google.co.in/url?sa=t&source=web&rct=j&url=http://www.dailyherald.com/business/20180203/analysis-what-happens-when-amazon-has-our-health-care-data-too&ved=2ahUKEwjfw86N9ebZAhXFFpQKHd1BBCMQFjAJegQIAhAB&usg=AOvVaw2QxHnds7y5QqNWEXu4BBvj

https://www.cnbc.com/2017/12/06/amazon-to-disrupt-the-dentist-next-dental-supplier-stocks-drop-on-new-threat.html

https://finance.yahoo.com/news/henry-schein-patterson-companies-downgraded-143929920.html;_ylc=X1MDMTE5Nzc4NDE4NQRfZXgDMQRfeXJpZAM0bDdkbzV0ZDR0M240BGcDZFhWcFpEeHVjejR5WVRrM09HTXhZeTAxT0RabExUTmlNR010WWpZNFppMDVOVFV3TnpKaVpqVmpaakoxZFdsa1BHNXpQa2hUU1VNPQ0KBGxhbmcDZW4tVVMEb3JpZ19sYW5nA3B0LUJSBG9yaWdfcmVnaW9uA0JSBHBvcwM5BHJlZ2lvbgNVUwRzeW1ib2wDSFNJQw--?.tsrc=applewf

https://www.amazon.com/b2b/info/amazon-business?layout=landinghu

https://www.forbes.com/sites/bisnow/2017/07/21/a-dozen-disruptions-amazons-pursuit-of-massive-market-share-in-12-major-industries/3/#3efd8f115c10

https://www.google.co.in/url?sa=t&source=web&rct=j&url=https://amp.usatoday.com/amp/1078823001&ved=2ahUKEwjfw86N9ebZAhXFFpQKHd1BBCMQFjAHegQIAxAB&usg=AOvVaw073JmGk6s9n7tMiVs5eXY1&cf=1

https://www.google.co.in/url?sa=t&source=web&rct=j&url=https://www.ft.com/content/0760f6c6-c8c4-11e7-ab18-7a9fb7d6163e&ved=2ahUKEwih29L1lufZAhWEJJQKHQc3ANkQFjAGegQIBBAB&usg=AOvVaw1YjfIDxCfeEWJ5JqKBkHF8