Every week we hear from doctors who say their first career goal is to pay off their debt.

Below, we’ll explore how those numbers are calculated and how some dentists have been lowering their debt load by upwards of $35,000 (for associates and private practice owners).

Bonus Material:

Want proven ways to lower your school debt?

Click here to get advice from one of the experts lowering dental school debt.

First, I want to commend the doctors who prioritize debt repayment. If you’re one of them, please smile and pat yourself on the back.

Unfortunately, however, debt is a reality for almost every doctor. Whether its school debt or practice debt, the investment in your career is increasingly requiring more dollars. The majority of doctors can relate to this as you’ll see below.

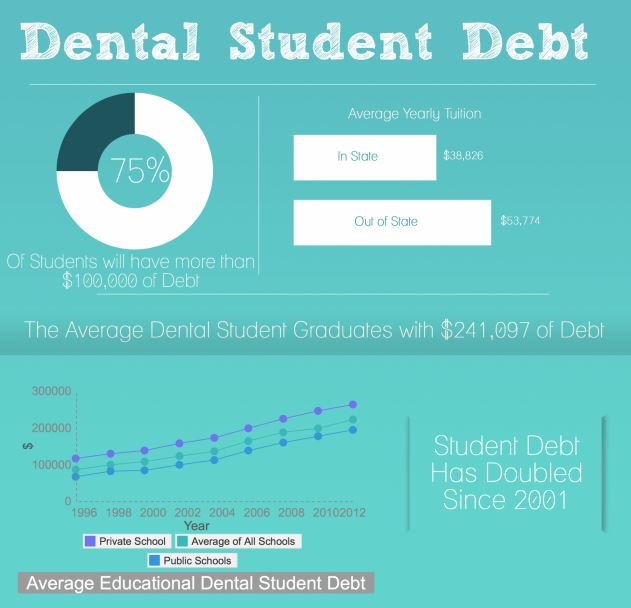

A great organization on this topic is ASDA. They’re the American Student Dental Association and they’ve got a lot of nice research out there for both seasoned doctors and students.

Take a look at this infographic from them:

You can also find the infographic here: http://www.asdanet.org/uploadedimages/The_Issues/Student-Debt-Infographic.pdf

Information Versus Application

I once heard it said that knowledge is good, but knowledge correctly applied is power.

Dentists who carry those levels of debt have a hard time moving forward financially. The stress and the limits that debt puts on your career options can be crippling. So many of the doctors we work with in opening new offices tell us they wish they would feel much better about their future prospects if they could reduce their debt.

How about you?

My personal hope is that the information here in this article will push you forward. But beware, the temptation may be to ingest the knowledge. Instead, I encourage you to take action and apply the knowledge to improve your financial situation.

Debt Levels Over $1 Million?

A few months ago, we posted a very long article on this topic here:

http://howtoopenadentaloffice.com/dental-graduates-2/

In it, you’ll see precise math that illustrates how some doctors will have a NEGATIVE net worth of $1 million dollars before seeing their first patient.

Is that a worst-case scenario? Sure.

The point is that dentists are being limited by debt.

Your ability to compensate team members who deserve the bonuses would be better. Vacations, lifestyle, stress levels and even the ability to offer patients care with the latest technologies are all improved when debt doesn’t get in the way.

Your ability to compensate team members who deserve the bonuses would be better. Vacations, lifestyle, stress levels and even the ability to offer patients care with the latest technologies are all improved when debt doesn’t get in the way.

Since my firm holds a strong stance on the advocates for practice ownership we’re constantly searching for ways that doctors can increase their odds of entering into practice ownership.

Below, we’ll point to one such resource.

How much better would practice ownership be with lower school debt?

Lower Dental School Debt Levels

An outstanding resource to lower your dental school debt levels is a firm named Sofi.

Check them out here: www.sofi.com/crown

Check them out here: www.sofi.com/crown

They help the average dentist lower their dental school debt load by $35,000.

That level of decrease can offer some fantastic options for any dentist looking into practice ownership.

Increase Your Knowledge in 35 Minutes

If you’d like to hear an a 35 minute interview with the co-founder of the firm, you can listen here

|

How to LOWER your dental school debt by $35,000

|

For some, dental school debt might not be an issue. If that’s you, please share this article with doctors who can benefit.

For others, if you’re a doctor who is feeling the pain and weight of your dental school debt, know  that you’re not alone. There are proven, reasonable ways to enter confidently and boldly into a stable financial future with a good debt management plan.

that you’re not alone. There are proven, reasonable ways to enter confidently and boldly into a stable financial future with a good debt management plan.

Whether or not you intend on stepping into practice ownership, you can control your future financial situation by making adjustments now. When you do, debt levels will decrease faster and your options for freedom in your personal, clinical and financial life improve dramatically.

Apply this knowledge, keep focused on accelerating your dental school debt repayment and open up your future to powerful options.

Founder, HowToOpenADentalOffice.com

Bestselling Author, Practice Location

Host, Ideal Practices Podcast

Chief Advocate for Practice Ownership

To view the original article please Click Here.